Introduction Bullish Belt hold lines is a one day candlestick pattern. It is a single candlestick pattern that occurs during a downtrend and signifies a potential reversal or continuation of the bullish trend. What is Bullish Belt Hold Lines Candlestick pattern? A...

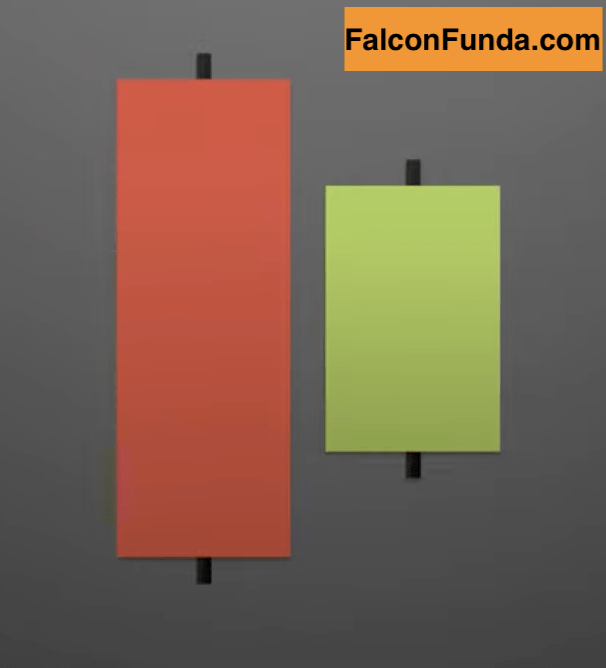

Bullish Harami

The Bullish Harami pattern is a two day pattern. It is made with one bullish candlesticks and a bearish candlestick. This is a potential trend reversal pattern and it is not as significant as a engulfing pattern or hammer. First day a ...

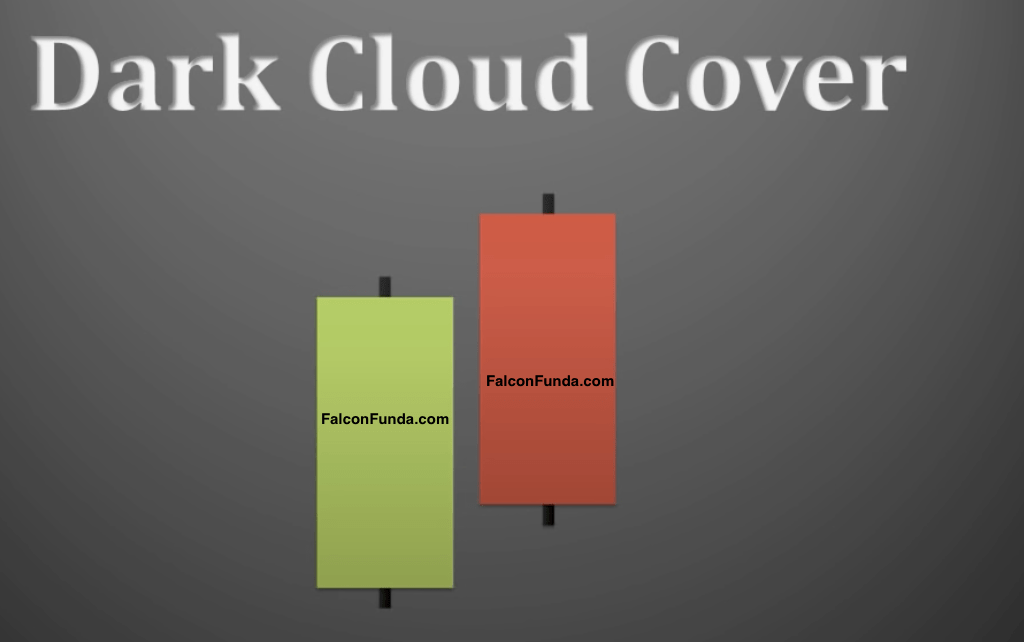

Dark Cloud Cover

The Dark Cloud Cover is a two day pattern. It is made with one large bullish candlesticks and a large bearish candlestick. This is a trend reversal pattern which occurs on top of an uptrend. Dark Cloud Cover is also called Bearish Piercing Line. First day...

Support and Resistance

Support and Resistance is a technical analysis concept / strategy used by traders to refer to the price levels on the charts for a security. On a chart, resistance is the area around the highest point the price of a security reaches before it is pulled back i.e prices...

Market Sentiment

Market Sentiment is the overall consensus about a particular security or market in general. This can be one of Bullish, Bearish or Correction. A bullish sentiment describes a market condition when prices are on the rise or expected to grow. The phrase...

Transaction Costs

Transaction costs are incurred by a trader during buying and selling a security. These costs are on top of the price of the security that is being bought or sold.Depending on the type of the security, transaction costs can include broker/ commission fee,...

Volume

Volume is the total quantity of a particular security traded during trading hours on a given day or per transaction. For a given security, higher day trading volumes are considered more positive than the lower trading volumes because they mean more liquidity and...

Orders

In Trading an order is a set of instructions to a broker to buy or sell an asset on a trader's behalf. An order can be used to buy and sell securities like stocks, currencies, futures, commodities, options, bonds and other securities. Exchanges trade securities...

Buying and Selling

When you place a trade, you are either buying or selling a security in the market. Buyers who are buying believe the security value will likely rise. Sellers ( or Bears ) generally think its value is going to fall. Buyers and sellers affect the supply...

Market Price

In trading, price is the most recent price at which a particular security was bought or sold.The price of the security is mainly determined by the supply and also demand. Traders, Investors and Dealers interact in the market to determine the supply and demand which in...