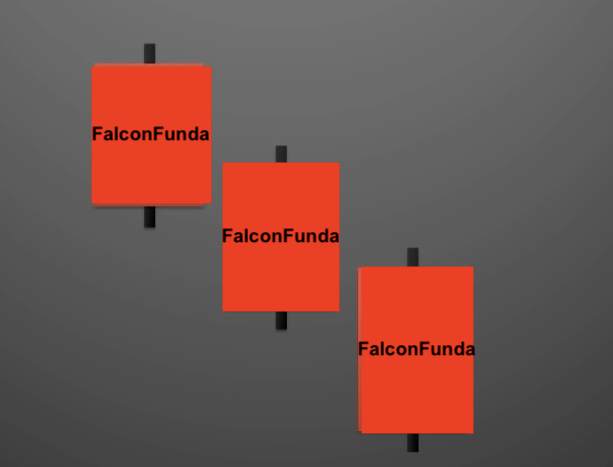

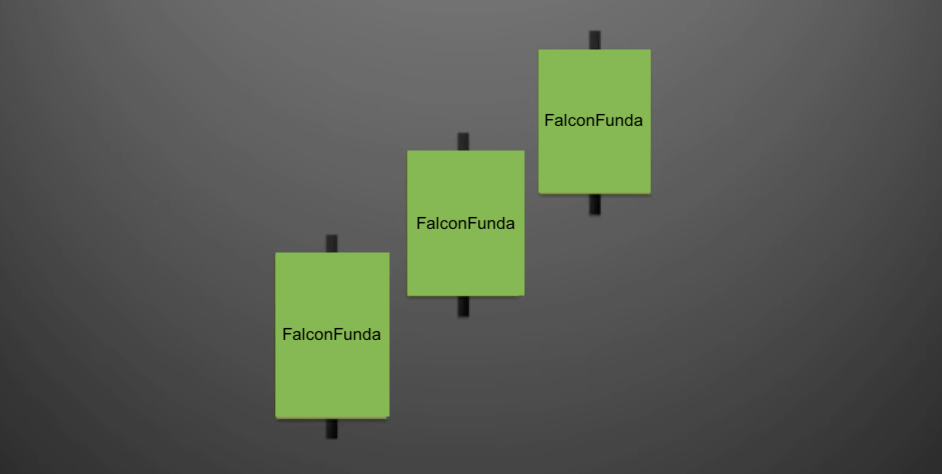

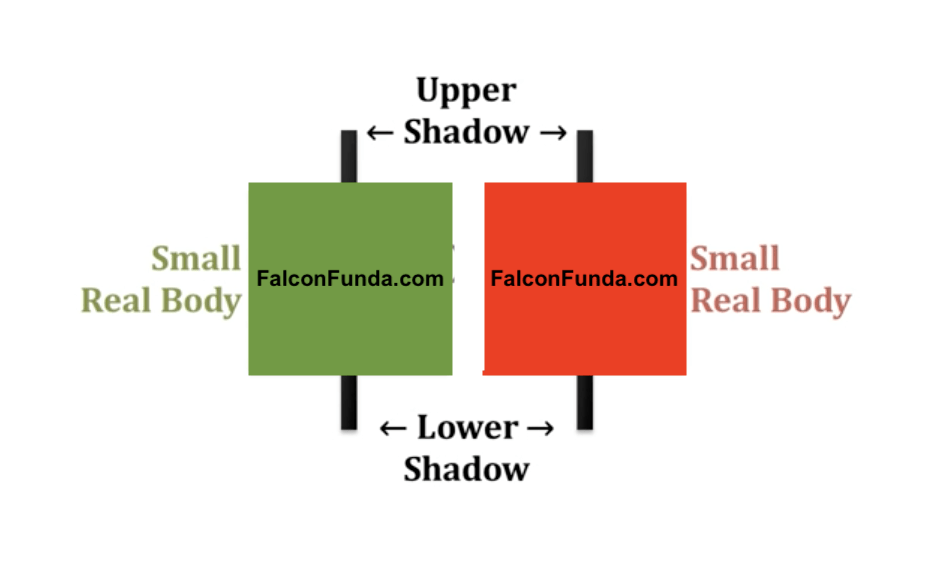

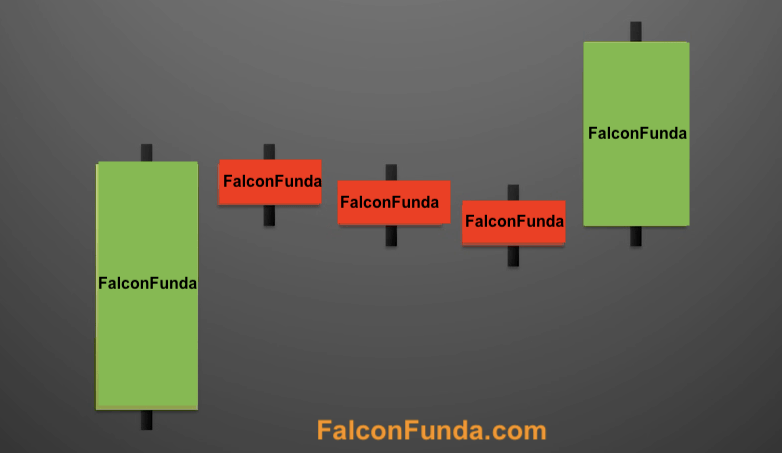

The Upside Gap Two crows is a three candlestick trend reversal pattern. This pattern occurs after an uptrend.Day1 has a longer bullish candlestick. Second day candlestick is a gapped up bearish candlestick and the real body should be above the real...